Credit card

0 Comments

Cash back sounds simple. It sounds safe. It sounds like the smart choice.

But for anyone who wants real travel value, cash back often becomes a ceiling instead of a strategy.

Here is why points usually deliver far more than a flat two percent return.

How Cash Back Caps Your Value

Earning two percent back on your spending is easy to understand. Spend 60,000 dollars in a year and you end up with 1,200 dollars in cash back.

That is fine. It is free money for doing what you already do.

The problem is that cash back cannot grow beyond that fixed rate. No matter how long you wait, the value stays the same.

How Points Change the Math

Transferable points are different. Chase Ultimate Rewards and American Express® Membership Rewards can be used with airline and hotel partners, which unlocks much higher value.

Take the same 60,000 dollars of annual spending. Earning around 1.5 points per dollar in transferable currencies would give you about 90,000 points.

The real question is what those points can do.

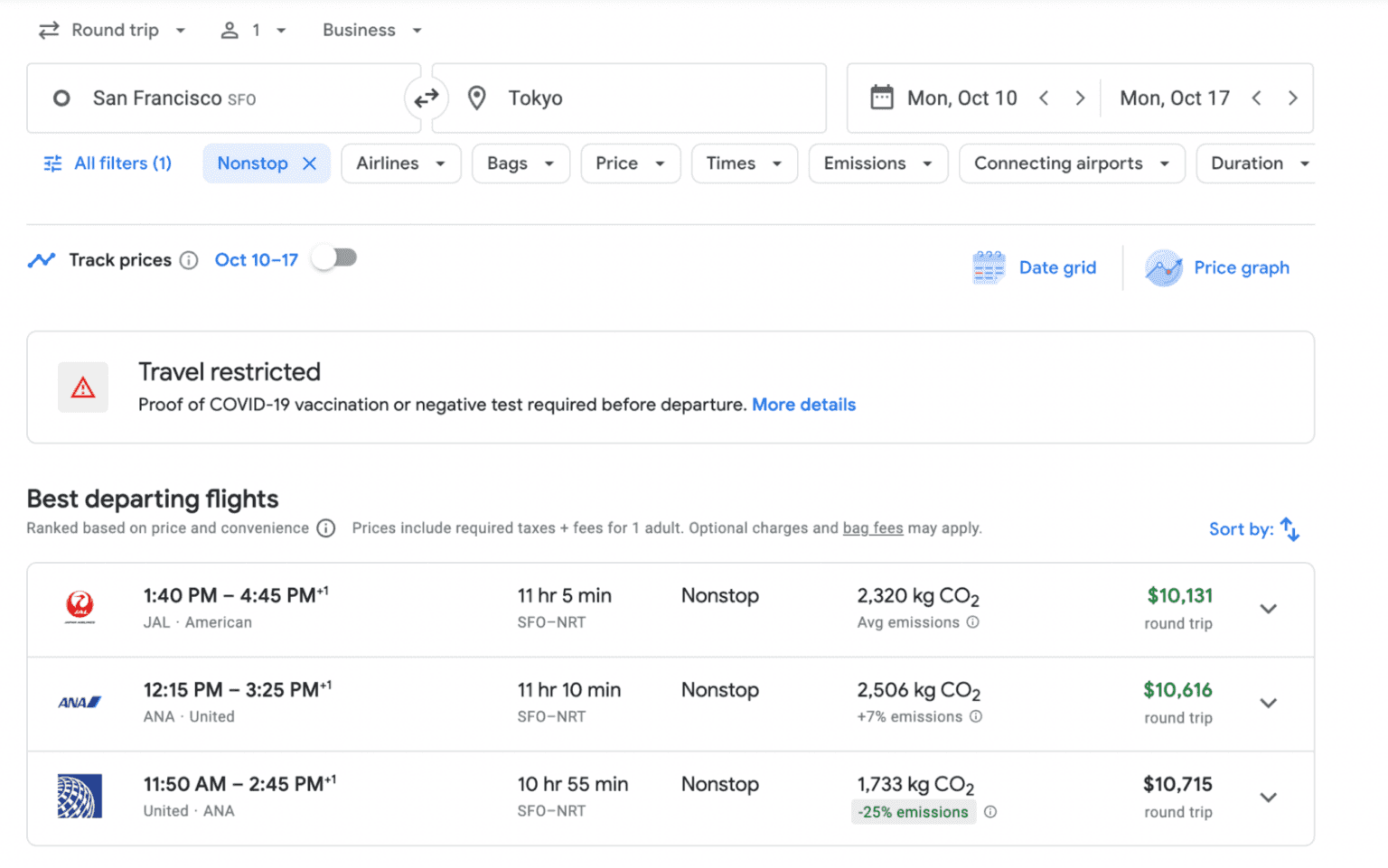

A business class flight from San Francisco to Tokyo often sells for eight to eleven thousand dollars round trip. Cash back would require years of saving to cover even one ticket.

Points can turn that same flight into an award that costs about 85,000 points round trip. That leaves you a few thousand points to spare and gets you an experience cash back cannot touch without a long wait.